Cedar Realty (NYSE:CDR) Preferreds are trading down about 50% on the M&A announced on 3/2/22.

They should be down even more.

Wheeler (NASDAQ:WHLR) preferreds are up about 10% at the time of this writing. I think the WHLRP should be down and the WHLRD is more complex which I will discuss more later.

Different tranches in the capital stack continue to be a source of mispricing as Wheeler’s acquisition of Cedar is some really dirty M&A. The value creation, if there is any, comes from a cram down on helpless Cedar preferreds. The winners in this transaction are Keybank, DRA Advisors, KPR Centers and Cedar common while the losers are Cedar preferreds, and to a lesser extent, Wheeler preferred B.

Wheeler is a tiny company at a market cap of $20 million so it takes quite the maneuver for them to acquire Cedar which has just over a billion in real estate.

While Wheeler is buying CDR they are not getting a majority of the assets. 33 of Cedar’s shopping centers are going to a joint venture managed by DRA Advisors and KPR centers in exchange for $840 million. 2 of Cedar’s most promising redevelopment projects are going to Northeast Heights for a combined $80.5 million.

Wheeler’s consideration in the deal is $291.3 million which I believe consists of $130 million in cash from a fresh Keybank loan and assumption of just over $160 million of CDR preferreds.

Prima facie, preferreds have superior rights to common in that they come first in the waterfall and their dividends must be paid in full before the common can get a dividend. However, preferred shares do not have voting rights in most cases which makes them susceptible to financial trickery.

When a cumulative preferred dividend goes unpaid, it accrues and adds to the liquidation preference which a preferred holder is owed. In theory, this should make it more valuable over time as the liquidation preference continues to rise, but what happens if the dividend is just never paid?

It is a move referred to as a cram down – where it is clear to preferred holders that the company has no intent or perhaps ability to ever pay the dividend. Accrual doesn’t mean much if you are never going to get paid and so the market price tends to collapse when this happens.

Although not formally stated in any company documents, I believe this is what just happened to the Cedar preferreds and what has already happened to the WHLR preferreds which have already been accruing unpaid dividends for years.

Cram down’s such as this come with a huge reputational cost to the company. It nearly eliminates the ability of the company to raise future equity of either common or preferred because of the damaged trust. In this case, however, WHLR already had a severely bruised reputation due to a history of destroying shareholder value and the accumulating accrual of dividends on the Wheeler preferreds.

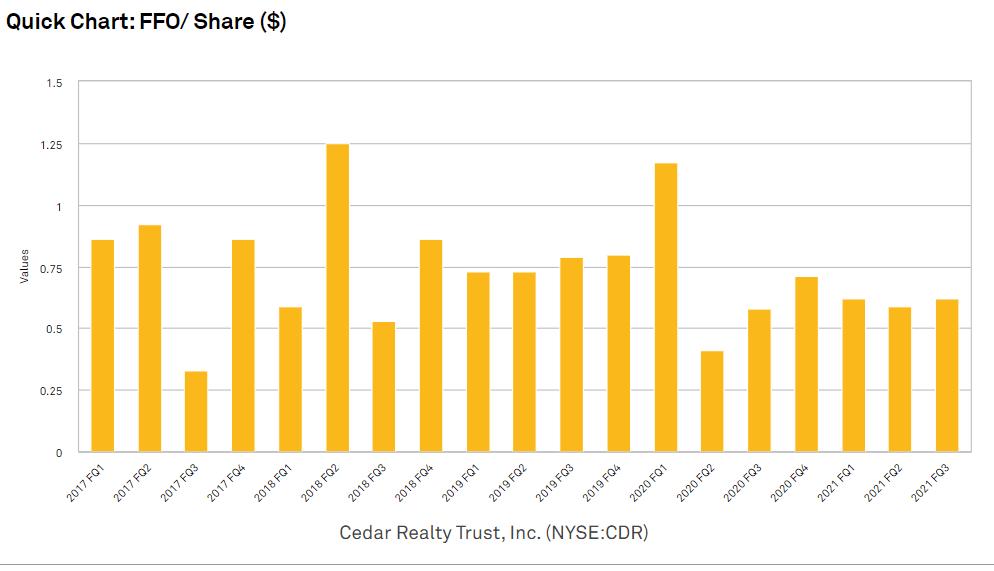

Pre-merger, the Cedar preferreds were attached to Cedar which owned a medium sized portfolio of grocery anchored shopping centers, some of which were quite desirable real estate. The company has no doubt had a bumpy road with both internal struggles and previous macro challenges to the shopping center sector. Despite the difficulties, revenues and net operating income were fairly stable, leading to volatile, yet consistently positive FFO (funds from operations).

With a solid asset base underneath and positive cashflows, Cedar was current on the preferred dividends with both the Series B and Series C getting paid on 2/22/22

With reasonably high coupons and seemingly an asset base capable of supporting them, the preferreds had significant value. Cedar Preferred B (NYSE:CDR.PB) has a liquidation preference of $36.250 million and was trading slightly above par.

Cedar Preferred C has a lower coupon of 6.5% so it was trading slightly below par and has a liquidation preference of $125 million

The aggregate value was about $161.25 million.

While preferreds are not recorded as liabilities on the balance sheet, they are functionally liabilities from the perspective of the common shareholder because preferreds are more senior in the capital stack.

Cedar has been attempting to sell itself as part of its strategic review and it seems they have finally found a way to unlock significant value for the common.

If we look at the whole Cedar waterfall, they had assets of a certain value and that value was supposed to pay the debt and the preferreds with the remainder going to the common.

But what if this $161.25 million of preferred could be detached from the quality assets, set aside and nearly all of its value removed? Then more could trickle down to the common.

I have no way of knowing the intent of the companies or what was premeditated versus just how it played out, but this is potentially a rationale for the way in which the merger with WHLR was structured.

It is extremely dirty and I don’t condone it, but I’m not here to pass judgement, I am here to analyze stocks and the opportunity they present. With that in mind let us take a look at the winners and losers of this transaction and what might be an actionable opportunity, or in this case, a bad investment to avoid.

Cedar common shareholders come out ahead with total payments of $29 per share. I don’t see this as an investable opportunity presently as CDR is trading at $28.50 and there is an above normal risk that this merger does not go through. It is unclear exactly what recourse the preferred holders have, but I would not be surprised to see them at least attempt some sort of legal road blocks. The 50 cents of potential remaining upside is not a large payout relative to the risk.

Cedar preferreds, although significantly cheaper than they were pre-merger are dangerous investments and I would be inclined to sell if I had any, which thankfully I don’t. Wheeler does not have enough cashflowing assets to finance the preferred dividends alongside their mountain of debt and the pre-existing WHLR preferred dividends.

Wheeler preferred B appears to be worse off after the M&A than it was before. No common equity was added beneath it but $130 million of debt was added above it with the Keybank loan that Wheeler took on to finance the merger. The $161 million of Cedar preferreds will now be pari passu with the WHLR preferreds which reduces the waterfall value in the event of partial payoff in a liquidation.

Wheeler preferred D is a bit more interesting. It has a redemption clause in which holders can force conversion into common or cash starting on September 21st, 2023. The redemption value will be the $25 par value plus the accrued and unpaid dividends. From the 10-K

“Looking ahead to 2023, beginning on September 21, 2023, holders of the Series D Preferred will have the right to cause the Company to redeem their Series D Preferred at a price of $25.00 per share plus the amount of all accrued but unpaid dividends. This redemption price is payable by the Company, at the Company’s election, in cash or shares of the Company’s

common stock, or a combination of cash and shares of the Company’s common stock. Since January 2019, the Company’s Series D Preferred (of which there are currently approximately 3.15 million shares outstanding at December 31, 2021) have been accruing unpaid dividends at a rate of 10.75% per annum of the $25.00 liquidation preference per share of Series D Preferred, or at $2.6875 per share per annum. As of December 31, 2021, the outstanding Series D Preferred had a liquidation preference of approximately $78.81 million, with aggregate accrued and unpaid dividends in the amount of approximately $26.16 million.”

To me what this means is that the Preferred D will convert into a dominant portion of the common stock. The portion owned by WHLRD converts versus current common holders will depend on the market price at the time of conversion. My hunch is it will go at least 90% to WHLRD holders.

If one can successfully sell their converted WHLRD common shares it is potentially a good investment. The roughly $15 preferred today is supposed to convert into over $30 of common. Successful execution of this strategy, however, is where the risk comes in. With so much common being issued all at once it is unclear to me whether or not it will be possible to trade out of it before the price plummets.

It might be worth playing for someone with just the right skill set, high risk tolerance and extreme bravery. I prefer to invest in fundamentally sound stocks, but I did want to bring it up as a potential opportunity.

Grocery anchored shopping centers have broadly done exceptionally well since the pandemic. There are a number of peers that I think are well positioned such as Brixmor (BRX) and Urstadt Biddle (UBA).

Wheeler’s properties have seen some benefits from the macro strength in the asset class, but I don’t see how the benefit can make it through to common shareholders. The company is drowning in debt and preferreds.

In 2021 total revenues were $61.3 million.

$43.8 million went to operating expenses and another $33 million in interest expense on their $368.9 million of liabilities.

An additional $8.17 million of losses can be chalked up to accrual dividends on the WHLR preferred D as per the 10K:

“the Company had accumulated undeclared dividends of $26.16 million to holders of shares of our Series D Preferred of which $8.17 million is attributable to the year ended December 31, 2021.”

The total unpaid preferred dividends now sits at $26.16 million which is more than the entire market cap of Wheeler.

Now that the Cedar preferreds are added on to the stack, preferred dividend accrued liability will grow at an even faster rate. The math is quite simple; Expenses are much greater than revenues.

This merger buys them a bit of time and brings in fresh assets, but it will still take something miraculous to turn this company profitable.

It is possible WHLR common will do well if the NOI of grocery anchored shopping centers doubles over the next 5 years, but why as a shareholder would you want to climb out of a hole before realizing gains?

If one likes grocery anchored shopping centers there are much better ways to gain exposure. The aforementioned Brixmor and UBA are clean responsible companies trading at attractive valuations. Whitestone REIT (WSR) is less grocery anchored, but it still has access to the underlying fundamentals that are helping shopping centers do well.

For anything Wheeler or Cedar related, please use extreme caution and maybe a bit of extra due diligence.